8 Easy Facts About Private Wealth Management copyright Explained

8 Easy Facts About Private Wealth Management copyright Explained

Blog Article

The smart Trick of Independent Investment Advisor copyright That Nobody is Discussing

Table of Contents9 Simple Techniques For Lighthouse Wealth ManagementThe Ultimate Guide To Tax Planning copyrightThe Buzz on Independent Financial Advisor copyrightThe Ultimate Guide To Ia Wealth ManagementFascination About Private Wealth Management copyrightThe smart Trick of Private Wealth Management copyright That Nobody is Talking About

“If you used to be purchasing a product or service, say a television or some type of computer, you'll would like to know the requirements of itwhat tend to be the elements and exactly what it is capable of doing,” Purda explains. “You can think about getting financial information and support just as. Individuals need to find out what they are buying.” With financial guidance, it's crucial that you keep in mind that the product isn’t ties, shares or other assets.It’s things such as budgeting, planning pension or paying down financial obligation. And like getting a pc from a reliable business, buyers would like to know they've been getting economic guidance from a trusted specialist. Certainly Purda and Ashworth’s best conclusions is just about the charges that economic planners demand their customers.

This presented genuine regardless the charge structurehourly, payment, possessions under administration or predetermined fee (in the study, the buck worth of fees ended up being alike in each case). “It however relates to the worth proposition and anxiety on people’ component which they don’t understand what they are getting back in exchange for these charges,” states Purda.

Some Known Incorrect Statements About Investment Consultant

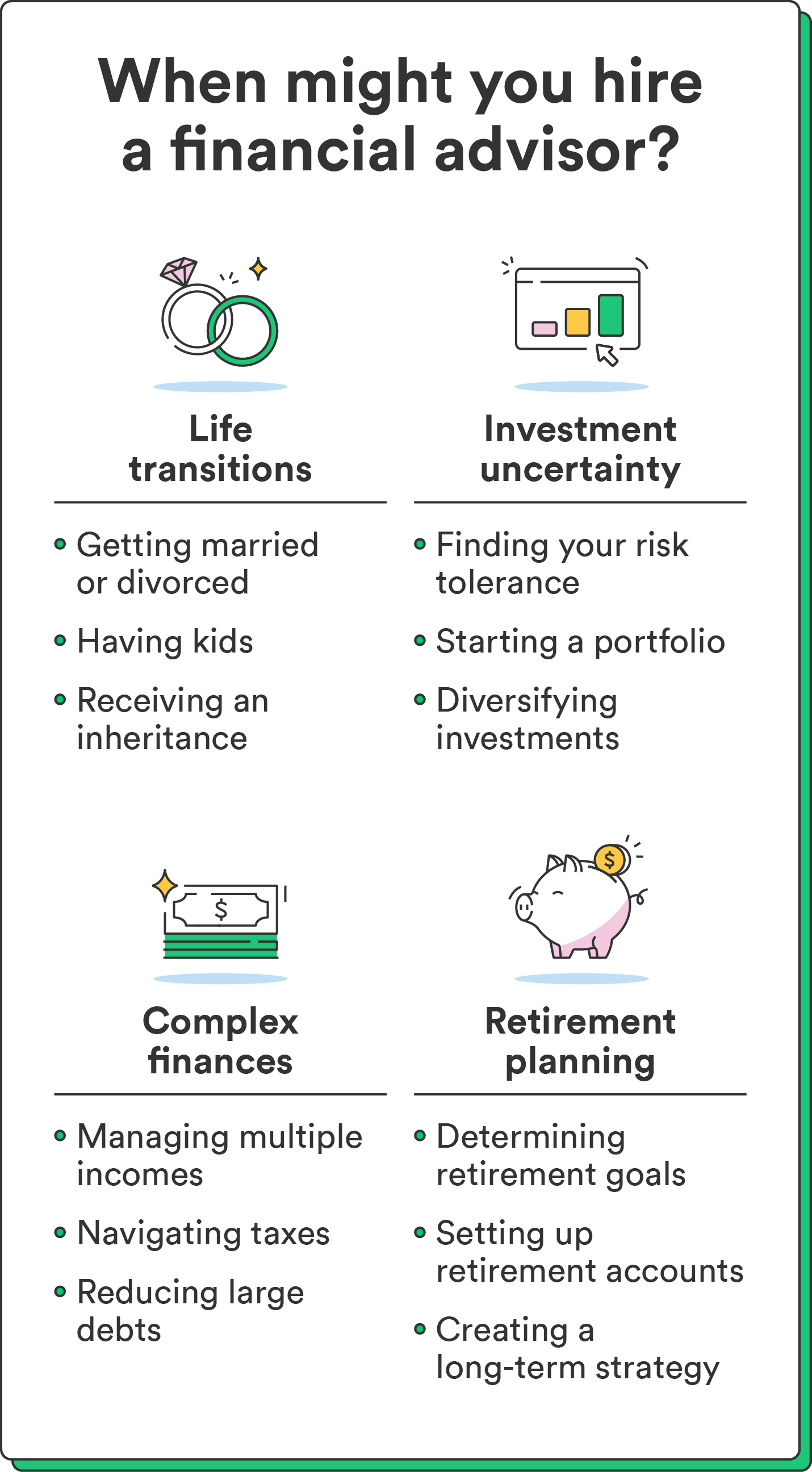

Hear this informative article once you hear the definition of economic expert, what comes to mind? A lot of people think about an expert who is able to provide them with economic advice, especially when you are looking at trading. That’s outstanding starting point, however it doesn’t paint the entire image. Not really close! Economic experts will people with a bunch of additional cash objectives too.

A monetary expert can help you build wide range and shield it when it comes down to long lasting. Capable estimate your future economic requirements and program tactics to extend your pension savings. They may be able additionally give you advice on when you should begin making use of Social protection and ultizing the cash in your your retirement accounts so you're able to prevent any terrible charges.

Indicators on Retirement Planning copyright You Need To Know

They can support find out exactly what shared funds tend to be right for you and explain to you simple tips to handle while making probably the most of one's investments. They are able to additionally let you comprehend the threats and just what you’ll need to do to experience your goals. A practiced financial investment professional can also help you stick to the roller coaster of investingeven whenever your opportunities just take a dive.

They are able to provide you with the advice you need to make plans so you're able to ensure that your wishes are performed. And you can’t place a price label about assurance that accompanies that. Per a recent study, the common 65-year-old couple in 2022 will need about $315,000 saved to cover health care prices in pension.

Independent Financial Advisor copyright Fundamentals Explained

Now that we’ve gone over just what monetary experts perform, let’s dig inside various sorts. Here’s good principle: All economic coordinators tend to be financial advisors, however all analysts are planners - https://www.slideshare.net/carlosprycev8x5j2. A monetary coordinator focuses primarily on helping folks create plans to reach lasting goalsthings like beginning a college fund or keeping for a down cost on property

So how do you know which economic consultant is right for you - https://www.4shared.com/u/kgVWRQiu/carlosprycev8x5j2.html? Listed below are some actions you can take to ensure you are really employing just the right person. Where do you turn when you yourself have two terrible options to pick from? Simple! Discover even more possibilities. More options you may have, the more likely you happen to be to manufacture an effective decision

Rumored Buzz on Private Wealth Management copyright

The Intelligent, Vestor plan makes it possible for you by revealing you as much as five economic experts who are able to last. The good thing is actually, it’s free to get connected with an advisor! And don’t forget to come to the meeting prepared with a list of concerns to ask so you can ascertain if they’re a great fit.

But listen, even though a specialist is actually smarter versus ordinary bear doesn’t let them have the right to reveal how to handle it. Occasionally, advisors are loaded with on their own simply because they have significantly more levels than a thermometer. If an advisor starts talking-down to you, it is time for you suggest to them the entranceway.

Remember that! It’s essential along with your monetary advisor (anyone who it eventually ends up getting) are on the exact same web page. You want an expert who's got a lasting investing strategysomeone who’ll motivate one hold investing consistently perhaps the marketplace is upwards or down. retirement planning copyright. Additionally you don’t wish to use an individual who forces you to definitely purchase a thing that’s too high-risk or you are unpleasant with

Investment Representative Things To Know Before You Get This

That combine provides you with the diversification you need to successfully spend for any long haul. Whilst study monetary advisors, you’ll probably encounter the expression fiduciary responsibility. All this suggests is any advisor you employ must act in a way that benefits their particular customer and never their very own self-interest.

Report this page